Skin in the Game

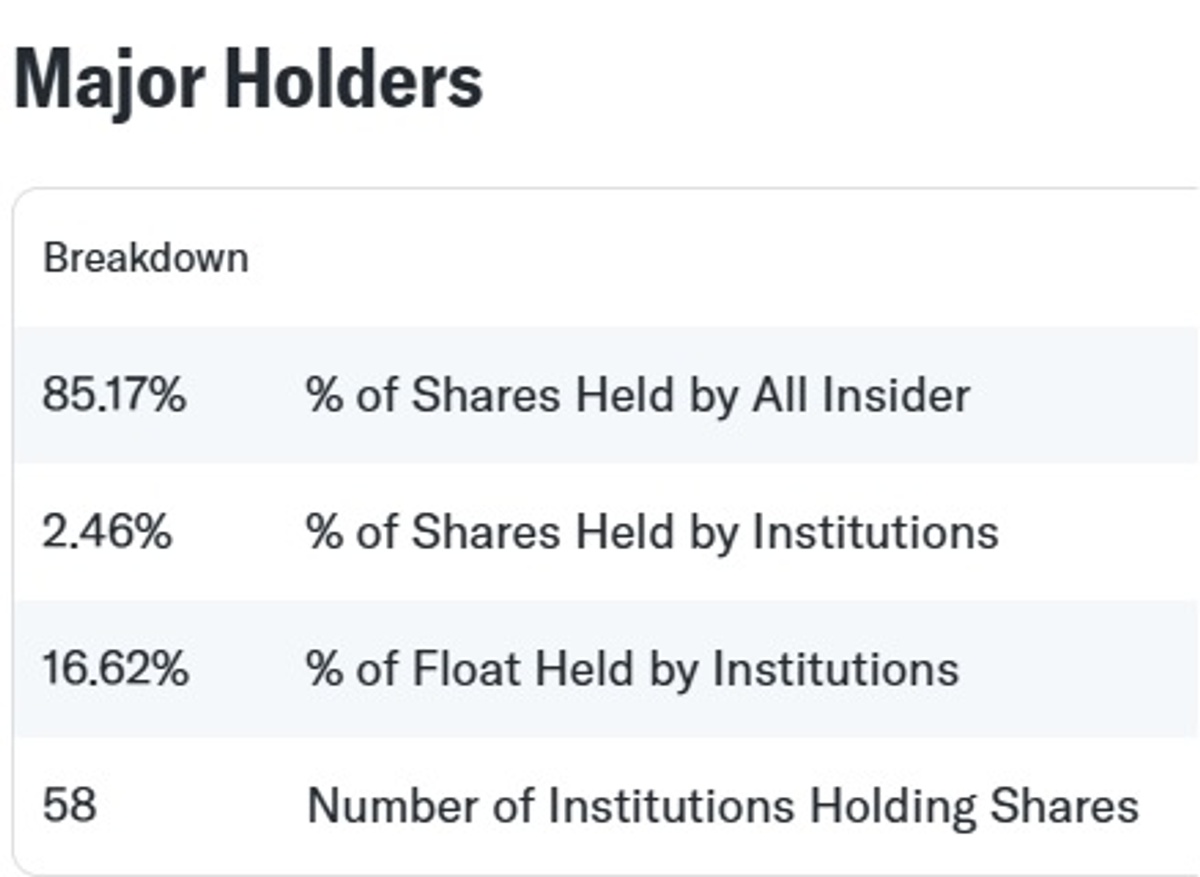

High insider ownership is often seen as a double-edged sword, but it also reflects strong leadership commitment. Following the acquisition of Meridianbet, 85% of shares in Golden Matrix Group (NASDAQ: GMGI) are held by insiders—a clear indication of alignment between leadership and shareholder interests.

To draw a comparison, Oracle founder and executive Lawrence Ellison holds approximately 40% of his company’s shares, a figure often viewed as a positive indicator of leadership confidence. Similarly, GMGI demonstrates strong alignment with shareholder interests, led by Aleksandar Milovanović, a key stakeholder and industry veteran with over 40 years of experience.

Liquidity Concerns? Here’s the Flip Side

High insider ownership often raises questions about liquidity, but GMGI’s growing institutional interest addresses these concerns. In FY2024, 58 institutions have increased their positions in the company by an average of 4.5%, reflecting their confidence in GMGI’s long-term strategy.

With 16.62% of the company’s float now held institutionally, GMGI is steadily improving its liquidity while preserving the leadership alignment that supports its stability and growth trajectory.

A Unique Player in Gaming

The gaming industry is often associated with high risk, but GMGI distinguishes itself through its ownership of proprietary technology via Meridianbet—a rare characteristic among gaming companies globally. This dual role as a gaming operator and technology innovator highlights GMGI’s forward-thinking approach to the industry.

In addition, GMGI employs a highly diversified strategy. Vertically, it spans B2B, B2C, retail, online gaming, lottery, and sweepstakes through its brands, including Meridianbet, RKings, Expanse Studios, and Classics for a Cause. Horizontally, GMGI operates in over 25 countries across multiple regulatory environments, with a historical presence in more than 55 countries over the past two decades. This broad diversification helps mitigate risks tied to single markets or regulatory changes.

While gaming may be perceived as a volatile sector, the reality today is quite different. Over the last decade, the industry has become one of the most strictly regulated sectors globally, with compliance standards comparable to those of financial services.

With operations across 25+ countries and new sports betting licenses in Peru, South Africa, and soon Brazil (via Meridianbet), GMGI is entering markets valued at over $22B. The company’s diversified portfolio, stringent regulatory compliance, and operational integrity provide a robust foundation for long-term stability and growth.